The financial crisis at Evergrande, one of China’s largest real estate developers, takes a new twist with the seizure of luxury properties belonging to its chairman, Hui Ka Yan. As the group struggles to avoid liquidation, the collapse of another industry giant, Country Garden, and its implications for the Chinese economy underscore the scale of the crisis. This is leading to debates on regulatory policies and solutions to stabilize the real estate market and prevent economic contagion.

On November 22, 2023, two luxury properties belonging to the chairman of property developer Evergrande, Hui Ka Yan, were seized by an unidentified creditor. The properties, worth over HK$1.5 billion (US$192 million) and located in The Peak, one of Hong Kong’s most prestigious districts, will be officially seized in the coming days.

Hui Ka Yan had pledged these homes to Orix Asia Capital Ltd in November 2021. Another neighbouring property was seized by China Construction Bank (Asia) in November 2022. Evergrande, which has been in financial difficulty for two years, must submit a new restructuring proposal by December 4 to avoid liquidation, while its main assets in Hong Kong were seized by creditors last year.

Meanwhile, a new Chinese group, Zhongzhi, an ultra-indebted asset manager worth over €125 billion, is facing a Beijing police investigation into alleged offences. Little known to the general public, Zhongzhi is a major market player, managing the assets of numerous Chinese companies and individuals. The real estate crisis triggered by the collapse of Evergrande and the economic slowdown have plunged companies specializing in asset management, such as Zhongzhi, into serious difficulties. The latter has now declared itself insolvent, with an estimated debt of 60 billion euros, which could have significant consequences for the Chinese financial system.

Fall of the Country Garden giant

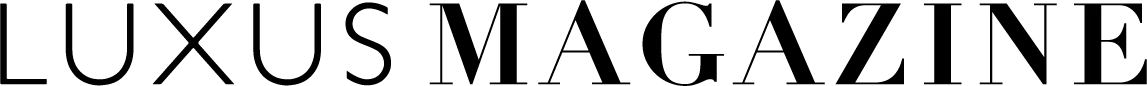

The troubled property developer Country Garden, one of China’s largest, also collapsed on the stock market in August. Its heavy debt burden (150 billion euros) is weighing on its financial health and causing concern among investors. One project in particular symbolizes the real estate group’s folie de grandeur, and is undoubtedly no stranger to the crisis it is experiencing.

Dubbed “Forest City” and launched in 2016, this $100 billion megaproject for a “smart, green city of the future” in southern Malaysia, near Singapore, is proving to be an abject failure. It has even been described as a “ghost town” by observers and the media who have visited the site. While the city was originally intended to accommodate 700,000 inhabitants on four artificial islands stretching over 30 km2, only a few thousand live there today. Only 28,000 residential units have been completed to date, and only one of the four islands has been fully developed.

The main culprit is that housing prices are far too high for the local clientele. They are reportedly sold at around 2,800 euros per m2, when the average monthly salary in Malaysia is no more than 700 euros. Some apartments can even cost more than $1 million (916,000 euros). As for foreign buyers, particularly the wealthy Chinese whom the project initially targeted, they were put off by contradictory statements from the Malaysian authorities. In 2018, the Malaysian Prime Minister stated that he would not allow foreigners to buy in Forest City, before retracting his statement.

Symbol of the Chinese real estate crisis

The American “Chapter 15” procedure aims to manage insolvency cases involving several countries. The Evergrande conglomerate ran into financial difficulties in 2021, with a debt exceeding $300 billion, following the Chinese authorities’ tightening of control over the real estate sector. Symbolizing the crisis in the Middle Kingdom’s private real estate sector, Evergrande attempted to restructure its debt by offering to exchange it for new bonds and a stake in its subsidiaries, notably the electric vehicle division.

Ongoing restructuring procedures are taking place in Hong Kong. And while fears of collapse and contagion have preoccupied the world’s second-largest economy in 2021, analyst Yan Yuejin is reassuring, viewing Evergrande’s move as a quest for better debt restructuring. However, the financial difficulties of Evergrande and the giant Country Garden are exacerbating the crisis in China’s real estate sector, making potential buyers wary and weighing on the financial system, which accounts for between 14 and 30% of GDP.

Direct impact on the Chinese economy

China’s huge real estate market plays a crucial role in the economic prosperity of China, and by extension, to some extent, the world. Despite decades of continuous growth, expert analysis has revealed a collapse in the sector. This crisis led to the bursting of the economic bubble in China, making it a major contributor to the global economic slowdown.

Historically, residential property has been the main investment vehicle for the majority of Chinese, driving market growth. However, this boom has also fuelled speculation, prompting developers to take on more debt to build an increasing number of homes to meet demand.

Zhao Yanjing, professor of urban planning at Xiamen University in Fujian province, attributes the current crisis to clumsy and populist government intervention, aimed at controlling housing costs through measures such as price controls. In his view, these initiatives have hampered developers’ ability to make profits and repay their debts. Highlighting companies such as the widely-publicized Evergrande, Zhao Yanjing points out that the bankruptcy or declaration of bankruptcy of such companies could trigger a massive industry-wide recall of debts by global banks and lenders. This would then lead to an economic collapse affecting developers, lenders, homeowners, as well as the construction and home renovation industries.

Is a resolution possible?

In the current crisis, Zhao Yanjing highlights the oversized role of land and land sales in China’s economic development. Local governments, in particular, have used them to stimulate economic growth. But when the central government steps in to curb speculation with price controls and other measures, this crucial source of funding is compromised. For Zhao Yanjing, the property market makes up the vast majority of China’s capital market. Consequently, if there is no continuous rise in real estate values, the logic of the system becomes unbalanced and overall growth slows down.

Zhao Yanjing therefore proposes a two-step approach: central and local governments should quickly, if not immediately, reverse the policies put in place in 2022 to cool the market and put an end to speculation. According to the expert, without speculation, asset prices fall, and some healthy incentives disappear. Taking Singapore as an example, Zhao Yanjing also stresses the need for governments to invest massively in affordable housing to counter the effects of speculation.

For him, this approach is the best way to enable a growing number of Chinese to reach the middle class, or even the upper class. He suggests that those excluded from the real estate market in 2022 could occupy subsidized housing for a few years, save money and accumulate assets with a view to participating in the speculative real estate market at a later date, if they so wish. Zhao argues that massive state investment in affordable housing would be far more sensible than building new infrastructure such as roads and airports, which China generally favors in difficult times.

Read also>THE STORY OF THE MOST PARISIAN OF RESTAURANTS : MAXIM’S

Featured photo : ©Press