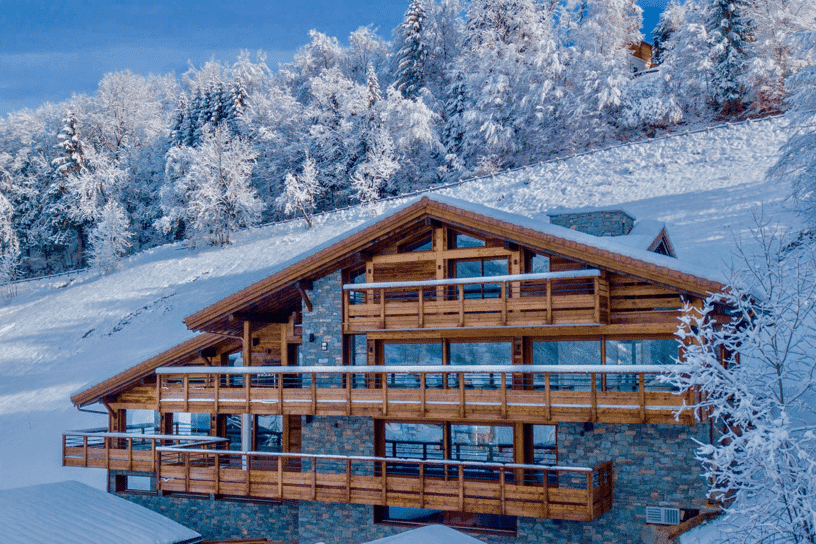

For the past two years, luxury real estate in the mountains has seen an increase in demand, attracting more and more investors. This can be seen in the French Alps, but also in Switzerland. David Prétot and Frank Casanova, respectively head of BARNES Mont-Blanc and BARNES Swiss Licensing SA, explain the reasons for this trend.

Gstaad and Mégève are the most expensive mountain resorts on the Swiss and French markets. What are the reasons for this success, and how do you explain such a high price per square meter?

David Prétot : Megève has a number of advantages: the living environment, with unspoiled nature and fresh air. It also has the advantage of being close to many dynamic cities, whether Geneva in Switzerland, Chamonix, or other mountain resorts. Moreover, in summer and winter, walking on sunny days or skiing when the first snowflakes appear are the main activities of the region. It is a living environment that attracts many city dwellers from the big cities or the Rhone Valley.

Frank Casanova: Gstaad is located in the canton of Bern, in the Swiss-German region. It is one of the few resorts that welcomes both Swiss Romans and Swiss Germans. The community also has a small airfield and well known international schools. There are few properties here because of its “off-market” positioning, which attracts a fairly well-to-do clientele.

How do you explain the fact that luxury real estate is booming in the mountains, with a strong increase in demand in 2020, despite the pandemic?

DP: People needed to isolate themselves, to get back into the open air, to leave the cities. Spending a confinement in the mountains is not the same as spending it in a Parisian apartment. With the crisis, people needed space, and Megève was there to offer it. In addition, with teleworking, more and more people are considering moving out of the city, only to return when necessary.

Frank Casanova: Switzerland became a kind of health paradise during the Covid-19 crisis. Even at the height of the crisis, habits did not change much, we had no curfew for example. There was still a sense of freedom. All this made people think that if another pandemic broke out, Switzerland would be the ideal refuge, and this did not escape the attention of investors.

While these figures are positive, has the health crisis had an impact on the real estate market?

DP: With the crisis, many homeowners needed a place in the country to spend the confines in the best way, away from the cities, looking for some peace and quiet. Teleworking was the trigger for many people: they found in the mountains the peace and isolation necessary for the best possible conditions for remote work.

Frank Casanova: It must be said that the crisis had a positive impact. Those who had wanted a pied à terre in the mountains for a long time were able to take the step and afford it. Even those who live in the mountains all year round have decided to carry out their projects, for example by extending their property. Everyone has started to rediscover their home. However, our rate of transactions has remained high in the face of a reduced and selective offer.

What are your forecasts for this winter (sales and rentals)? And your objectives?

DP: I think that sales and rentals will continue once winter comes. People with higher incomes are coming to the mountains more and more, and it seems that this movement will not be short-lived.

Frank Casanova: We already know that winter is dynamic, for several reasons. We have been on a positive curve in terms of investments for several years, with the purchasing power of the wealthiest people increasing. In addition, the craze is real because we all want to get back to normal life. Certain habits will resume, such as going to the mountains in winter, and this will potentially open the doors to new transactions.

This article is taken from the Fall-Winter issue of Luxus+ Mag.

More news and features in Luxus+ Mag paper version or online !

Read also > LUXUS+MAG DEVOTES A SPECIAL REPORT TO THE MOUNTAINS IN ITS AUTUMN-WINTER ISSUE

Featured photo : Frank Casanova & David Prétot © Barnes