Against a backdrop of rapid transformation, Saudi Arabia is mobilizing to strengthen its international influence through soft power. Through a series of cultural, economic and diplomatic initiatives, the country is seeking to reshape its image and play a more prominent role on the world stage.

Operation seduction for Saudi Arabia. For Crown Prince Mohammed Ben Salmane (MBS), the country’s post-oil economy will be built on tourism, focusing on sports such as soccer and golf, and culture, thanks to its many Nabataean archaeological sites. All of this, backed by substantial investment in luxury hotels.

The recent acquisition of Paris Saint-Germain’s star player, Brazil’s Neymar, has confirmed the kingdom’s soft power strategy. In general, the kingdom spends colossal sums to attract Western players to the Saudi Pro Football League.

And the Saudi regime is insatiable. Last June, it flexed its muscles in yet another sporting discipline, concluding a merger agreement between the PGA Tour and LIV golf associations, the latter backed by the kingdom’s Public Investment Fund (PIF).

A way for the country to change its image as a rigorist kingdom and try to beat its rival, Qatar, on this terrain. MBS has still not come to terms with his neighbor’s hosting of the FIFA World Cup. The question now is what happens next. Saudi Arabia has not officially bid for the 2030 World Cup, but it’s only a matter of time. Cricket is also attracting interest in the country, not least because of the high proportion of the population of Indian, Pakistani and Bangladeshi origin.

Next month, Saudi Arabia will also play host to Gamers8, billed as the world’s largest e-sports and gaming festival. Two things to remember: money wins, and everything has a price in business.

As Saudi Arabia’s sporting ambitions gather momentum, questions persist about the underlying motives. Yet one obvious answer is emerging: it’s a sports laundering operation, where sport is employed both as a soft power lever and a way of improving the lives of the population, particularly young people (70% are under 35), and diversifying the economy. The Saudis are touting 8% annual growth in their sporting events industry, up from $2.1 billion in 2018 to an estimated $3.3 billion by next year. The aim, for example, is to attract more visitors to Saudi Arabia to play golf and spend their foreign currency locally.

To complete this strategy, Saudi Arabia is seeking to improve its oft-criticized human rights record. In return, the country has introduced important reforms for its citizens in recent years. These include the reopening of cinemas, the organization of concerts and the granting of driving licenses to women…

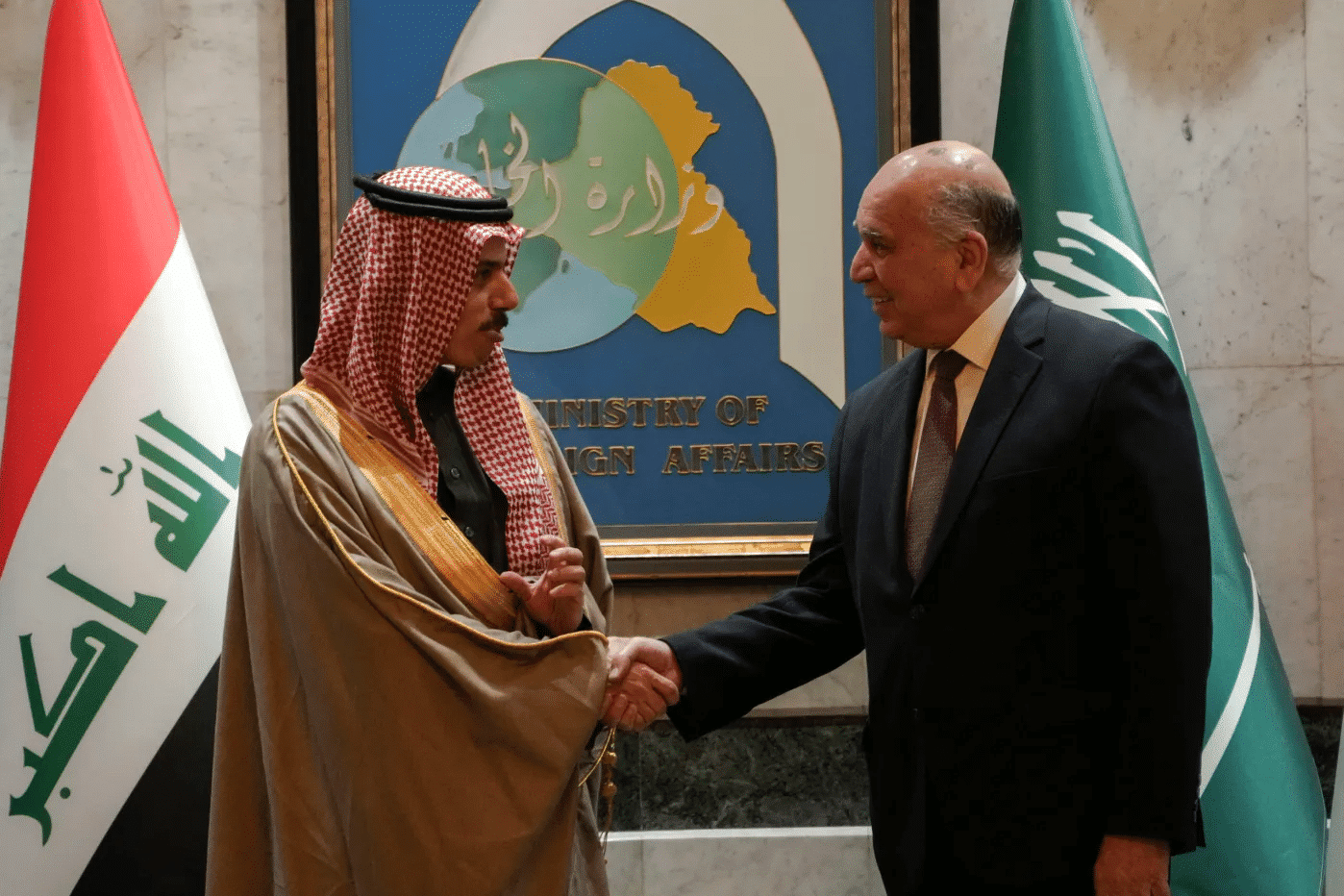

Reopening of the embassy in Iran

On the diplomatic front, Saudi Arabia is also scoring points. Iran has reopened its embassy in Saudi Arabia, ending a seven-year rift between the two nations. Iran’s Deputy Foreign Minister, Alireza Bigdeli, expressed that the decision reflected a new era of cooperation. The move comes three months after the Gulf states agreed to renew relations in a deal mediated by China. In 2016, Saudi Arabia severed ties with Iran following an attack on its embassy in Tehran by protesters opposed to the Kingdom’s execution of a prominent Shia Muslim cleric.

For decades, Saudi Arabia, claiming to be the dominant Sunni power, and Iran, the largest Shiite state, have been vying for regional influence. However, these rivalries have been exacerbated in recent years by proxy conflicts in the Middle East. In Yemen, since 2015, Saudi Arabia has been supporting forces loyal to the government in their fight against Houthi rebels. For its part, however, Iran has denied any support for the Houthis, who have carried out missile and drone attacks against Saudi targets, including cities and oil infrastructure.

In addition, Saudi Arabia has accused Iran of interference in Lebanon and Iraq, where they have allegedly supported Shiite militias, which have gained considerable military and political influence. Iran has also been accused by Saudi Arabia of attacks on ships and tankers in the Gulf, as well as of responsibility for a major attack in 2019 on important Saudi oil installations. Iran, however, has denied any involvement in such operations.

Resumption of soft power in Iraq

After two decades of withdrawal, Saudi Arabia has also re-established its soft power role in Iraq. In early June, the country signed an agreement with the Iraqi government to provide essential medical assistance throughout the country. The Saudi ambassador to Iraq, Abdulaziz Al-Shammari, officially announced the launch of this initiative, orchestrated by the King Salman Center for Humanitarian Aid and Relief, at a widely publicized event. In addition to medical supplies, Saudi Arabia will send highly qualified and experienced doctors, including neurosurgeons, cardiologists, podiatrists, optometrists and nurses.

This extensive medical assistance campaign is part of a general warming of bilateral relations. Much of this improvement can be attributed to the ongoing efforts of the Saudi-Iraqi Coordination Council, established in 2017. At the launch of the medical campaign, Mr. Shammari highlighted the crucial role played by the council, stressing that the two countries “are reaping the fruits of the fruitful and remarkable relations between Iraq and Saudi Arabia, thanks in particular to the Iraqi-Saudi Coordination Council, and that these successes are the result of the enlightened leadership of the two nations’ leaders.”

The medical campaign and educational exchange programs are expected to strengthen cultural ties between Saudi Arabia and Iraq, and contribute to improved diplomatic relations. Saudi Arabia’s medical aid to Iraq is apparently part of a larger “soft power” initiative aimed at winning the favor and trust of the Iraqi population. A positive reputation will most likely help Saudi Arabia to further expand its presence in key areas in Iraq such as energy, investment and finance.

Investment in tourism

On another front, Saudi Arabia plans to invest hundreds of billions of dollars in its tourism sector over the next ten years.

“The kingdom will invest more than $800 billion over the next ten years,” said Saudi Minister of Tourism Ahmed bin Aqeel Al Khateeb recently.

The Minister also announced that the tourism sector’s contribution to the country’s economy had risen to 4.45% of gross domestic product by 2022. The Ministry has devised comprehensive plans to boost the travel and tourism sector, which accounts for 3% of the employment market. With a 121% increase on pre-pandemic international tourism levels, Saudi Arabia recorded 93.5 million visits in 2022. As one of the main players investing in the tourism sector, the country has pledged to invest $550 billion in new destinations by 2030.

At the 22nd World Travel & Tourism Council (WTTC) Global Summit, held in Riyadh at the end of last year, Julia Simpson, President & CEO of the WTTC, declared that the organization’s members were ready to invest more than $10.5 billion in the kingdom. According to a recent report by real estate consultancy Knight Frank for the year 2023, the Kingdom has planned a rapid expansion of its hotel sector: indeed, it projects the creation of 315,000 additional hotel rooms by 2030, which would represent an estimated development cost of $37.8 billion.

Faisal Durrani, Partner and Head of Middle East Research at Knight Frank, commented: “The volume of hotel room keys forecast for the Kingdom by 2030 is simply incredible, with a likely total stock of almost 450,000 hotel rooms. The success of the Kingdom’s future tourism and hospitality market will rely heavily on the domestic tourism sector. This sector is already alive and thriving, with 65% of Saudis already traveling within the kingdom between one and three times a month.”

Help from digital

Highlighting the rapid expansion of the digital landscape in Saudi Arabia, the Director of the Saudi Tourism Authority, Mr. Hamidaddin. He stressed that the integration of the latest technologies would ensure a seamless and authentic cultural experience for visitors to the country. In this way, he said, digitization was the fundamental foundation of the tourism sector. Saudi Arabia’s e-visa has been hailed as the best digital platform.

“We used to say that you have to digitize the expected and humanize the unexpected. So, while digitizing the services that deliver a seamless experience and journey, we must remain true to Arabia, (be) uniquely Saudi and authentically local in every destination,” said Hamidaddin. “Today, we have 26 agreements with Chinese online travel agencies; so, all along the value chain, we are prioritizing digital.”

Amr Al-Madani, Director General of the Royal Commission in charge of the Al-‘Ula archaeological site, mentioned that the domestic tourism sector is expected to make up around 75% of the Gulf nation’s gross domestic product.

Read also >Saudi Arabia: the new Eldorado of luxury tourism?