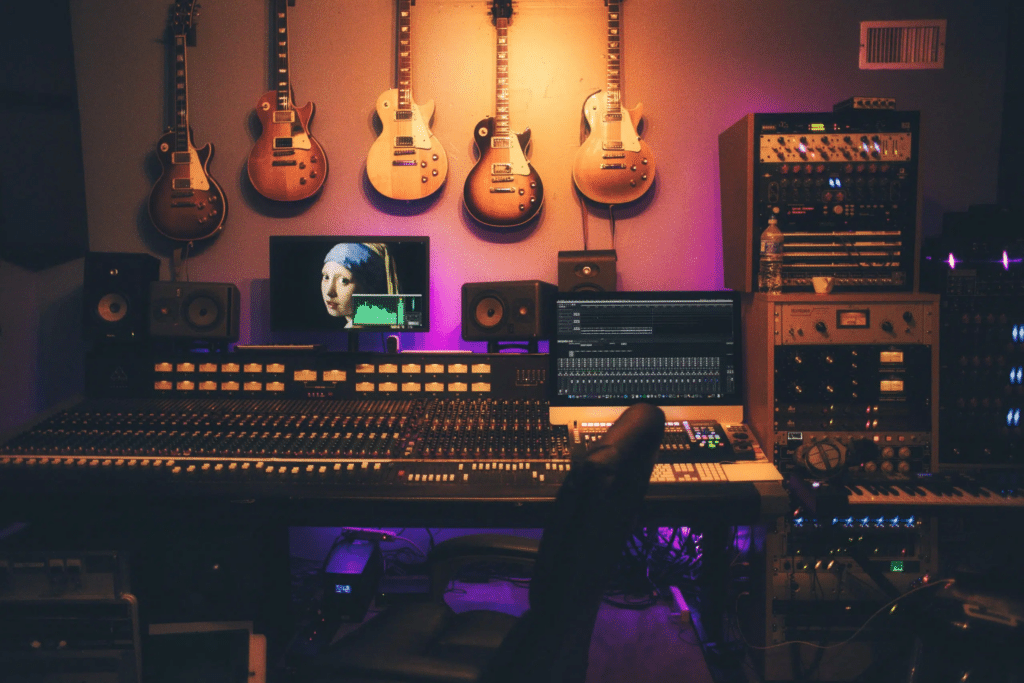

The music festival industry is now dominated by the giants AEG and Live Nation, threatening the cultural diversity and independence of smaller festivals based essentially on associative models. This concentration of power creates major economic and security challenges. Faced with inflation and economic uncertainty, small festivals are struggling to survive.

The music festival landscape is gradually darkening, marked by the growing dominance of two giants: AEG and Live Nation. While revenues from record sales and streaming are eroding, live music has become increasingly important to artists and record companies alike. The concentration of economic power at work with the arrival of the American behemoths raises major challenges for small independent festivals, faced with galloping inflation and growing economic uncertainty.

AEG (for Anschutz Entertainment Group) and Live Nation, with their vast financial and logistical resources, dominate the music festival market. Their strategy of acquiring and partnering with established festivals enables them to consolidate their hold on the sector.

These companies, owned by billionaires, wage a fierce battle through their subsidiaries, aiming to dominate the music industry by monopolizing artists, ticketing, venues and festivals. However, the results achieved by these festivals are mixed.

“In France, we can’t talk about a dominant position, because festivals are rather complex objects for the big groups. If we take Live Nation as an example, its recent acquisitions are rare, if not non-existent in the festival sector”, points out Emmanuel Négrier, director of research at the CNRS and author of several works on the festival question.

Festival expansion

AEG has strengthened its presence in France by including major events such as Rock en Seine, founded in 2003, in its portfolio. This expansion enables them to benefit from economies of scale and impose their conditions on the market, creating a dynamic that is unfavorable to smaller players.

“We’re looking to produce more and more artists, such as Taylor Swift, Ed Sheeran, Björk, Frenchmen like Ibrahim Maalouf or Polo & Pan, and to develop festivals on a European scale. In France, we’d like to establish ourselves in the regions within the next two years, and we’re looking at all opportunities, both in terms of festivals and even venues,” explains Arnaud Meersseman, head of AEG Presents France.

Live Nation, meanwhile, controls a significant share of the global concert and festival market. Their influence extends far beyond event organization, to include artist management and show production, enabling them to monopolize the entire music industry value chain.

“These groups are both operators of shows, some of them owning labels or holding positions in them, and portfolios of artists who are part of the headliners that everyone snaps up,” adds Matthieu Barreira, lecturer at Lumière Lyon-II University.

Inflation weighs on safety

Inflation affects every aspect of festival organization, from the cost of raw materials (fuel for generators, wood and iron) to infrastructure and personnel, not to mention artists’ fees. So despite a record attendance in 2024, with 260,467 festival-goers for its 26th edition, the event’s viability is not assured. Solidays organizers note a +30% increase in artistic budgets, a phenomenon due as much to inflation as to growing competition from major European festivals backed by alcohol or tobacco brands. To keep costs down, some festivals are even abandoning exclusive contracts.

Others are opting for a premiumization strategy, such as Rock en Scène, which in 2022 integrated its first VIP area with associated services to meet the growing need for comfort among certain festival-goers.

Many choose toincrease their capacity, sometimes reaching 103% or 104% of their initial capacity. This strategy is aimed at maximizing revenue from festival-goers (ticket sales, bar, restaurant and merchandising revenues), but poses considerable logistical and security challenges. Another strategy adopted by the Beauregard festival, among others, is to organize a before, i.e. an additional date around a headliner such as David Guetta, Muse or Indochine. “This fifth day allows us to amortize our stage and structural costs. Thanks to this, we’ll be able to break even, but in the festival world, we’re at such a fragile point,” says Paul Langeois, director of the Beauregard festival, near Caen (Calvados).

Small festivals, which don’t have the same resources as large groups, are particularly vulnerable to these cost increases. They often have to juggle with limited budgets and little room for maneuver, which exposes them to greater financial risk.

“There is, ofcourse, an inflationary logic affecting artists, but also a regulatory framework that increases expenditure – safety, eco-responsibility – to which we are responding, and quite rightly so,” points out Boris Vedel, director of the Printemps de Bourges festival. While his festival remains relatively safe thanks to a model centered on creation, with 70% emerging artists, it is faced with an “economic challenge”.

Increasing capacity to offset rising costs can have dramatic consequences for festival safety. Recent tragedies, including the death of ten festival-goers in a crowd at Astroworld in 2023, illustrate the risks associated with overcapacity. The excessive influx of spectators has led to serious incidents, underlining the importance of maintaining strict safety standards, even in times of economic pressure.

Small festivals in difficulty

Small festivals, often organized by local associations or independent organizations, are the hardest hit by these economic and safety challenges. Facing them are titans who cede little territory, like AEG, which owns or manages over 350 venues of all sizes on five continents (including, in London, the famous O2, and in Paris 43% of the SEM operating the Accor Arena, the Adidas Arena and the Bataclan) but also 25 festivals, mainly located in the USA and England, as well as 50 sports franchises.

Les Vieilles Charrues, an emblematic festival in Brittany, founded in Landeneau in 1992, is in jeopardy despite a resounding success with 346,000 participants in 2023. The organizers denounce unfavorable local political decisions and new taxes imposed by the municipality of Carhaix, which they describe as “relentless”. A French festival rooted in the French country, the event benefits fromone of the largest budgets devoted to a festival (20 million euros, without any subsidies), this associative model depends largely on its 7,000 volunteers. 80% of the budget is provided by festival-goers, 20% by private partners.

“In less than a month, and without prior consultation, we have been faced with three decisions by the town of Carhaix and Poher communauté that threaten the festival. 1. Loss of essential land: half our campsites and several parking lots are affected. 2. Preemption of our future offices. These are located at the festival’s main entrance“, write the organizers of Les Vieilles Charrues on their social networks, before mentioning another major source of concern: ”3. A surprise tax of almost 400,000 euros for the Kerampuilh site, despite a 5-year agreement to make it available (in return for which the festival has made over 2 million euros in donations, works and shows, and offers the equivalent of 2,000 tickets each year to the town hall)”.

THREAD | Vous avez peut-être vu passer quelques nouvelles (inquiétantes) concernant les Vieilles Charrues… Voici les infos clés pour comprendre notre situation. pic.twitter.com/IKQqf2N9rV

— Vieilles Charrues (@Charrues) April 24, 2024

To raise public awareness and mobilize the support of artists, a petition was launched, testifying to the seriousness of the situation. To date, over 25,000 signatures have been collected, and several artists, including Santa and Skip The Use, have expressed their support for Les Charrues on Instagram.

By way of comparison, the heavyweight founded in 2006 is none other than Hellfest, which sold 240,000 four-day passes this year. Considered one of the biggest festivals dedicated to hard rock, metal and hardcore, it has a budget of 38 million euros. This is no mean feat for a niche festival, which, like Les Vieilles Charrues, operates on an associative model, receiving only 0.1% in subsidies. This status enables the festival to devote most of its profits to organization, artist fees, decorations and the improvement of reception conditions. This is a boon for Clisson (Loire-Atlantique), the town in which the festival is held, with annual spin-offs estimated at 20 million euros. The 2024 edition saw 1.6 million euros invested, 182 bands on six stages and almost 60,000 festival-goers every day.

In Switzerland, the situation is similar. The festival market here is also dominated by a few large groups, which worries the organizers of smaller events. The latter fear for their survival in the face of competitors with disproportionate resources, capable of adapting to economic fluctuations and attracting the biggest headliners.

AEG and Live Nation “have a strategy of occupying territory, seeking to monopolize as much space as possible and preserve their exclusivity without worrying about immediate profitability”, sums up Mathieu Jaton, director of the Montreux Jazz Festival.

Towards other sources of investment

To survive, small festivals have to innovate and find alternative sources of funding, thanks in particular to the Centre national de la musique, one of whose missions is to direct public support. Diversification of income, through partnerships with local businesses, crowdfunding initiatives and unique programming, can offer a breath of fresh air. These festivals can stand out for their ambience, location and community involvement, aspects that large-scale events cannot always replicate.

Support from local authorities is also crucial. Policies favoring smaller festivals, through subsidies or tax breaks, can help maintain the diversity and cultural richness of the musical landscape. In addition, greater regulation could limit the disproportionate influence of multinationals and ensure a fairer distribution of resources.

Rock en Scène, owned by AEG and Combat Media, Mathieu Pigasse’s company, has a budget of almost 15 million euros, 12% of which is covered by private partnerships and 5% by subsidies from three regions.

The music festival oligopoly, dominated by AEG and Live Nation, represents a major challenge for the industry. Inflation and economic uncertainty exacerbate the difficulties for smaller festivals, which have to navigate between the need to remain financially viable and the security of their events.

Striking a balance is crucial to preserving the diversity and cultural richness of music festivals around the world. The survival of these events depends on innovation, community support and favorable public policies. Ultimately, it’s the diversity of the cultural offering that enriches festival-goers’ experience and ensures the vitality of the global music scene.

Read also>Paris 2024: for the opening ceremony, Thomas Jolly proves that he is indeed a beast of the Seine

Featured photo : © Business of Fashion