The deadline for former US President Donald Trump to raise several hundred million dollars in bail to appeal his fraud conviction in New York expires this Monday. This astronomical sum has so far remained elusive for the former businessman. His lawyers have applied for a waiver of this bail, but in the absence of a favorable decision, what scenarios lie ahead?

Time is running out for Donald Trump. On February 16, the former President of the United States and his two sons, Donald Jr. and Eric, were convicted of financial fraud, with a total sentence of around $464 million in financial reparations to be paid.

Donald Trump is required to pay approximately $355 million, plus $100 million in interest, for a total of $455 million. For his sons, $8 million, also with interest, is due. Although they have appealed, the former President remains obliged to provide a guarantee of his ability to pay this substantial fine and to make the funds available to the courts.

This fine represents a considerable sum which could have a serious impact on the former President’s finances. In the absence of a bail waiver, Donald Trump could consider declaring bankruptcy, which would enable him to avoid payment. However, such a move could damage his image as a successful billionaire, affecting his popularity and electoral potential.

“If Trump can’t pay the half-billion-dollar bond, he faces humiliation and serious financial consequences,” says Carl Tobias, a professor at the University of Richmond Law School in Virginia (east).

Trump at an impasse

In a 5,000-page court document made public, Donald Trump’s lawyers admitted that it was unlikely he would be able to raise a bond of such magnitude, given that very few bail bond companies are willing to take on such a financial risk.

Donald Trump has claimed on social networks that he would have $500 million in cash, earmarked for his campaign, but this statement seems hardly credible. What’s more, although he has announced his intention to float his social network Truth Social for $3 billion, he won’t be allowed to sell his shares for another six months, which could constitute a financial impasse difficult to overcome.

This financial pressure comes on top of a series of costly legal setbacks for the former President, including his recent order to pay $5 million in damages to writer E. Jean Carroll for defamation.

Donald Trump denounces an “unconstitutional and illegal requirement for financial security” as well as “a political witch hunt” led by “racist and corrupt” New York State Attorney General Letitia James and Judge Engoron, “controlled by the Democrat clique”.

Real estate under threat

“If he doesn’t have the funds to pay the judgment, we’ll ask the judge to seize his property. He is guilty of massive fraud, this was not a simple mistake”, explained New York prosecutor Letitia James.

The African-American magistrate, an elected member of the Democratic Party and holding a prominent political office in New York, had filed a civil lawsuit against the Trumps and their company, the Trump Organization, in October 2022. This dispute was brought before the Supreme Court of the State of New York, the trial court located in Manhattan, and lasted until last January, culminating in the conviction of the Trump fathers and sons last month.

“If Trump misses Monday’s deadline, the Attorney General may try to seize the money he holds in New York and some of his real estate related to the case”. However, given the impact such seizures would have and the enormous political pressure on the New York judiciary, it’s possible that Attorney General James will “give him more time or negotiate a settlement”, Carl Tobias argues.

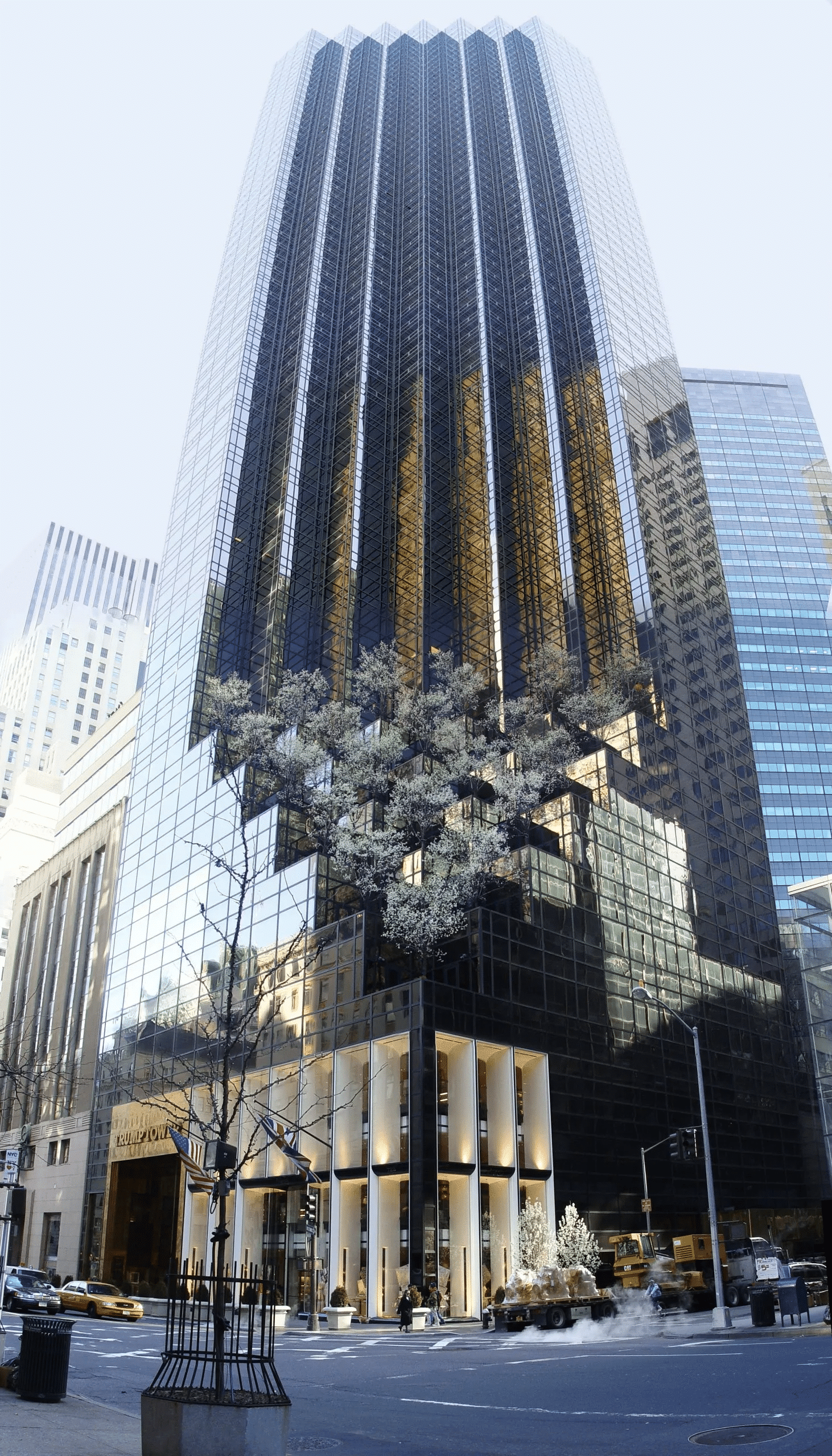

A seizure of Donald Trump’s assets could include putting his real estate properties up for sale, such as the Trump Tower on 5th Avenue and a building on Wall Street.

In addition, Judge Arthur Engoron ordered that certain of Trump’s business licenses be revoked and that some of his companies be placed in independent receivership.

Declining financial situation

The financial pressure on Donald Trump comes against a backdrop of declining wealth, as revealed by Forbes’ assessment of his net worth. Although he remains a billionaire, with assets valued at $2.6 billion in February 2024, he is no longer wealthy enough to feature in the annual Forbes 400 ranking of America’s richest people. By 2022, his fortune was estimated at $3 billion, down from $4.6 billion in 2016. Despite this drop, as of mid-March 2024, Forbes still estimates his net worth at $2.6 billion, ranking the former President 1,290th on the magazine’s list of the world’s richest people.

Donald Trump’s fortune is largely based on real estate, with investments in residential buildings in New York, golf courses and hotels around the world. According to Bloomberg, one of his main assets is his $500 million stake in 1290 Avenue of the Americas, a Manhattan office building. He also reportedly has $600 million in cash, and his Trump National Doral Miami Golf Resort is valued at around $300 million, according to Bloomberg.

Trump’s net worth has declined, however, for a number of reasons. In particular, the pandemic has affected some of his real estate holdings, with low demand for his office buildings due to the rise of telecommuting.

What’s more, its stake in Truth Social has failed to meet expectations. Although the company predicted a user base of 40 million, it only managed to attract 6.5 million by the end of 2023. This underperformance led Forbes to reassess the value of Truth Social’s parent company at $100 million, down from $730 million in 2022. Despite these setbacks, the planned merger between Truth Social’s parent company, Trump Media & Technology Group, and its financial partner could be lucrative for the former President. He is expected to receive nearly 79 million shares in the new merged company, which could net him up to $4 billion depending on his financial partner’s share price.

Read also>THE RACE FOR THE WHITE HOUSE HAS BEGUN, BUT WHO WILL EMERGE VICTORIOUS?

Featured photo : © Press