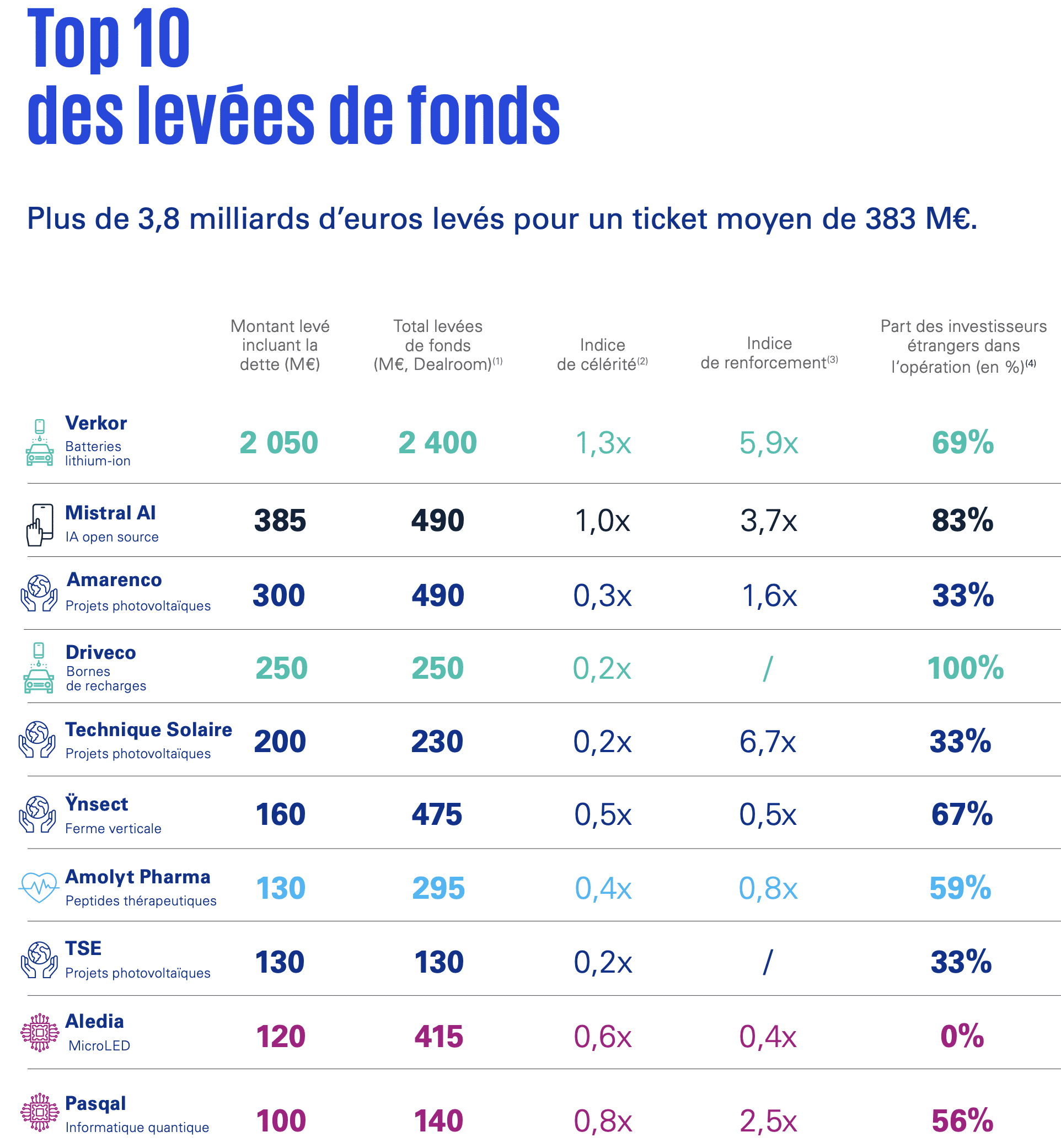

In 2023, the Frenchtech generated the second largest fundraising in Europe behind the United Kingdom, despite a 33% decrease compared to 2022 according to a KPMG study. At the origin of this performance, we find Verkor with its Gigafactory, innovations in Green Tech, and the new unicorn Mistral AI in artificial intelligence.

According to the “Tech Insights” study by the consultancy KPMG, published on January 18, French startups raised 8.3 billion euros in 2023. This represents a decrease of 33%, while their British counterparts experienced a 57% decrease compared to 2022. The mobility sector leads in France with the monumental fundraising of Verkor, followed by the sustainable technology sector. French companies are also seizing the opportunity represented by AI.

French Artificial Intelligence

At the CES in Las Vegas in 2024, France was the second most represented country with its 150 startups on site, most integrating artificial intelligence technologies. To compete with ChatGPT, the French Mistral AI, founded in April 2023, is the only French unicorn of the year with a valuation of 2 billion euros. According to a ranking based on user satisfaction evaluations, its open-source model is already superior to some versions of the leader, Chat GPT (according to data from huggingface.co). Mistral AI successfully raised 385 million euros to “create a European champion with a global vocation in artificial intelligence,” aims its CEO, Arthur Mensch.

Verkor: Future European Battery Leader

The startup Verkor has made a fundraising of 2 billion euros for the construction of its Gigafactory in Dunkerque. This factory will manufacture high-performance, low-carbon batteries for the European automotive industry, thereby strengthening the continent’s sovereignty in mobility. “It will equip 300,000 electric vehicles and create over 1,200 direct jobs,” according to Verkor’s website. The company was largely funded by investment funds dedicated to energy transition such as Macquarie Asset Management and Meridiam. It also benefits from the support of the Renault Group and the French State, which are supporting the startup’s development. “We are now well on our way to becoming one of the main European manufacturers of batteries,” estimates Benoit Lemaignan, the CEO of Verkor.

Frenchtech Fundraising on the European Stage

With 8.3 billion euros raised, France retains its second place in 2023 behind the United Kingdom, despite the latter’s significant 57% drop from 27 to 11 billion euros this year. “Not only does the French Tech ecosystem resist much better than those of other European countries, but major initiatives are being launched to strengthen it,” analyzes Nicolas Landrin, Executive Director of ESSEC Business School. Verkor and Mistral AI demonstrate strong and strategic French innovation to defend European interests. Behind the Franco-British duo, Scandinavia, Germany, the Benelux, and Spain follow. In seventh place, Italy appears fragile with a 68% decrease compared to 2022, only reaching half a billion euros in fundraising according to the KPMG report.

Experts Are Cautious but Optimistic

The decrease in fundraising is explained by an unstable economic and geopolitical context, according to analysts, with the Russo-Ukrainian conflict, rising energy and raw material prices, and increasing interest rates. The year 2023 was marked by growth in Green Tech and AI, to the detriment of Fintech and the Internet services sector, previously the stars of Frenchtech.

Companies with 11 to 15 years of existence recorded a 16% growth in their fundraising. They seem to reassure investors with their maturity and present more reassuring balance sheets.

KPMG identifies new demands on startups, with an increased need for transparency in activities and balance sheets, rapid and effective communication, and a commitment to ESG issues (environmental, social, and governance), which factor into the non-financial performance of companies. The progression of Green Tech can be correlated with this trend. “We anticipate an interesting year with a rise in growth sectors such as AI and GreenTech, combined with a decrease in rates, thus stimulating investments in FrenchTech,” analyzes a report from Ernst and Young for 2024.

Read also> CES 2024: HIGH-TECH INNOVATIONS YOU WON’T WANT TO MISS

Featured Photo: ©Gilles ROLLE